TRAXIA

TRAXIA is a new crypto project working on Cardano (ADA) blockchain, decentralized, scalable, fully open source and customizable with smart contracts creation.

Traxia is a fintech platform that aims to guarantee liquidity to Small and medium-sized enterprises (SMEs) that have difficult to access at credits.

The idea comes out by an evident difficulty of real worlds in which Banks finances only the 7% of short-term assets, extremely useful for the expansion of SMEs. So, how SMEs can access shortly to credits disrupting bank ecosystem?

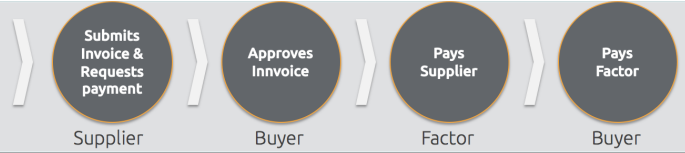

An SME has to digitalize and upload its invoices (to pay for 60/90/120 days) into the system and let professional investors trade them, transforming invoices into digital assets. Instantly and with the only use of the private key, the SME confirm the invoice accuracy and receive Fiat minus commission.

On the other side, who want to be a technological partner of the project streamlining this process, assure the transaction, getting a commission. Upon the technological partner, there is the liquidity provider like a fund (i.e.), that finances the operation in the first place receiving TMT tokens and then re-sell it in a marketplace to smaller Investors, getting a spread. On the same flat, there are professional investors that go to the market trading invoices (digital assets) trying to get margins.

Token Sale

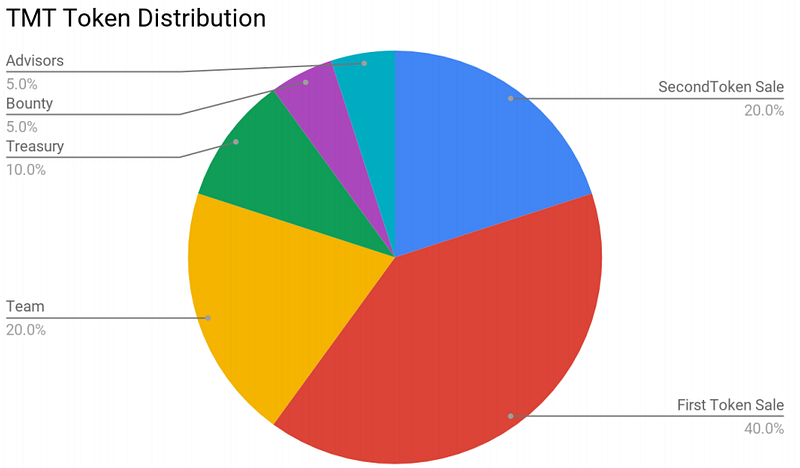

Total TMT allocation for Token Sale is 60%, other 20% is for Team, 10% for Treasury, 5% Bounty and 5% to Advisors. The Pre-Sale is divided into 4 stages, starting with a discount of 40% and token price of 40% and finishing with no discount at 18th of April. In the first stage the minimum amount to participate is 10 ETH and then, from the 19th of March, the minimum becomes 0,01 ETH. For whom want to participate in the first sale but haven’t 10 ETH, I suggest to visit primablock.com web page and create a pool on Ethereum blockchain. Is possible contribute also with Cardano (ADA) and the cap could be reached during pre-sale, avoiding the public sale.

The 6th of June TMT will hit exchanges Trade.io and Gatecoin with which already there is an agreement.

The token sale system is fully compliant with rules regulation.

Total supply of 1,000,000,000 TMT and hard cap to hit is of 41.4 million dollars, to spend into 64% Loan Warehousing, 11% Business Development & Sales, 15% Smart-Contract Development, 5% Legal and Compliance and 5% Contingency Budget. It’s very important to note that the major amount is going to be spent in Loan Wharehousing for assuring Liquidity Provider activity and so the work of platform.

Conclusion

The project is good structured and well thought, supported by Cardano community through its investment arm Emurgo, winner of Slush Shanghai 2017 Edition prize. The development team, called LiqEase, has a lot of records in launching and executing digital projects successfully for large corporations or independently and with deep knowledge of fintech world. Finally, Miguel Solana from Santander Bank and Mr. Kapron from Citibank, support the project, guaranteeing a long-term investment and big future success.

Disclaimer: this is my personal article within my personal opinions so please don’t consider it as a financial advice.

For further information:

Home Page: https://www.traxia.co/

Telegram Group: https://t.me/traxiafoundation

Official Bitcointalk thread: https://bitcointalk.org/index.php?topic=3019695.new#new

Bounty Bitcointalk thread: https://bitcointalk.org/index.php?topic=3021679.0

koteb17

Tidak ada komentar:

Posting Komentar